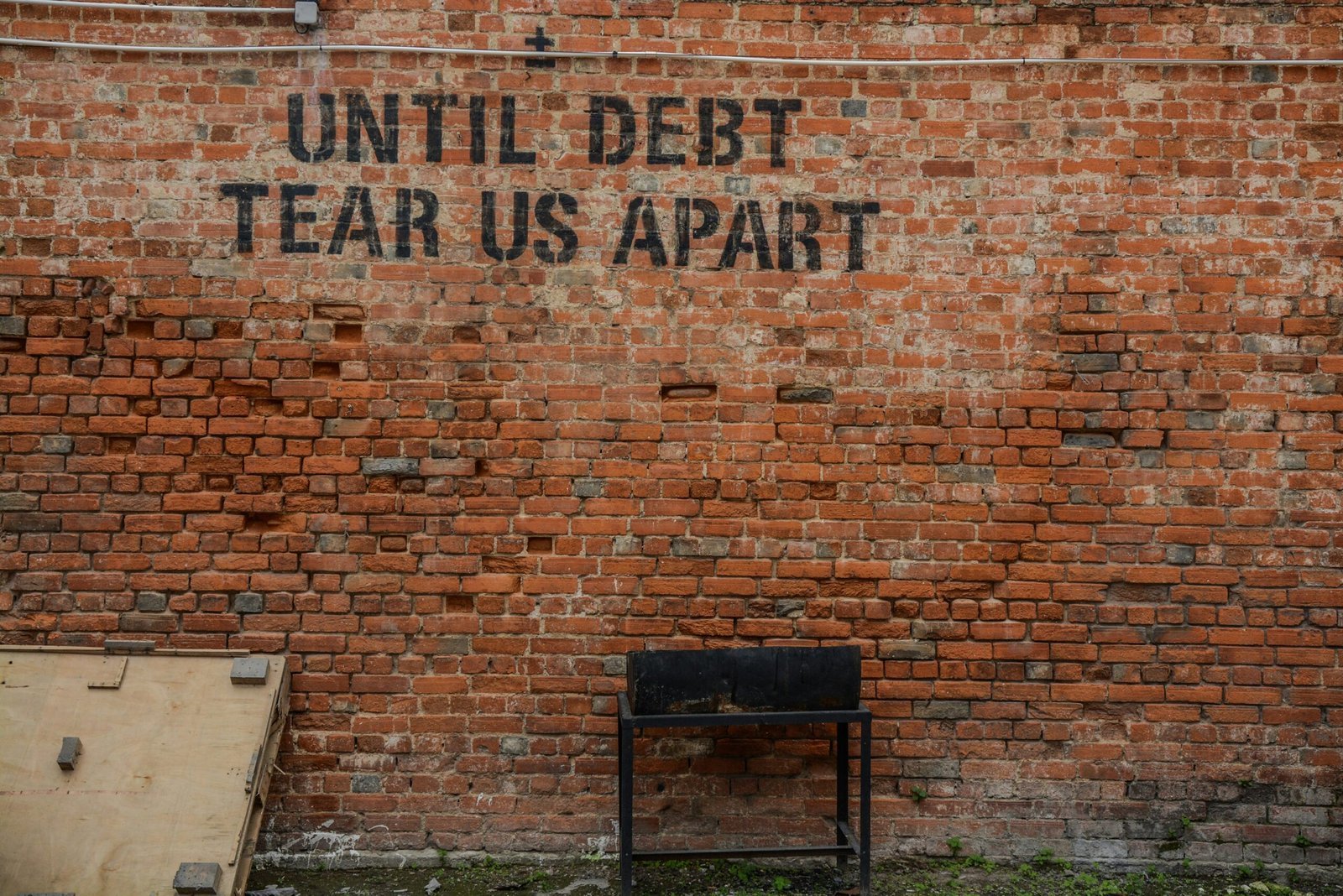

Understanding the Debt Landscape

Debt is a pressing issue for many individuals and families. that’s why we here to simplify your debt issues. It can feel overwhelming, especially when multiple monthly payments are involved. Understanding the types of debts—such as credit cards, medical bills, and personal loans—can be the first step toward financial wellness. Individuals often find themselves stressed, confused, and uncertain about how to manage these obligations.

Consolidation Solutions

One effective strategy for managing debt is consolidation. This process involves combining multiple debts into a single monthly payment. DebtRescue financial organizations offer services that can help individuals transition to this method. By consolidating debts, individuals can reduce the number of payments they handle each month, cancel arrays and interest, easing their financial burden. This simplification not only boosts their cash flow but also makes it easier to track payments and manage finances more effectively.

Crafting a Repayment Plan

Helping someone in debt often necessitates the creation of a personalized repayment plan. This involves assessing their income, expenses, and outstanding debts. By setting realistic, achievable goals, individuals can work towards paying off their debts consistently. Encouraging them to cut unnecessary expenses and allocate these funds toward debt repayment can facilitate progress. Over time, as they reduce their debt, clients can start to enjoy greater financial stability and peace of mind.